New retail realities help drive accelerated global growth for retail-ready packaging solutions.

No one can deny or dismiss the enormous competitive impact of online shopping and e-commerce retailing on the traditional brick-and-mortar retail outlets across North America. But neither should anyone discount the retailers’ ability to adapt to new challenges, however urgent and far-reaching they may be.

For all the promise and excitement of the disruptive power of e-commerce to alter modern consumers’ purchasing behavior—fueled by the meteoric growth of Amazon and other e-commerce powerhouses offering a vast growing range of everyday consumer staples for prompt home delivery at similar or lower—the lion’s share of average North American consumers continue to rely on traditional shopping outlets for a vast majority of their everyday needs, especially the food-and-beverage products.

That said, there has never been as much pressure on physical retailers to reduce their operating costs, their labor costs in particular, since the inevitable move by larger e-tailers into the grocery business, as highlighted by Amazon’s US$13.4-billion acquisition of Whole Foods Market earlier this year, followed by significant price-cutting of a large range of organic food products sold by the upscale retailer.

While some retailers have already responded in kind by either launching or beefing up their own e-commerce presence, many of them have accelerated efforts to achieve greater cost reductions at their stores and throughout their supply chains—ranging from introduction of automated self-checkout aisles to cutting back on operating hours—to counter the e-commerce firms’ inherent advantage of lower overhead costs.

As part of this cost-cutting, traditional retailers are also expected to increase their use of the so-called retail-ready packaging (RRP) solutions—also called shelf-ready, display-ready or pallet-ready packaging—which have already yielded impressive savings in shelf-stocking, product handling and inventory control costs since their widespread rollout across North American markets in the last decade.

Tubs of sour cream sit tightly in their cutouts inside a RRP tray made for the ALDI supermarket chain.

SHELFISH DESIGNS

Designed to allow the packaged consumer goods to be readied for sale or merchandising with minimal opening or set-up effort at the store level, RRP packaging such as die-cut pre-perforated corrugated boxes, die-cut display cases, shrinkwrapped trays and modified-atmosphere cases combine the practical advantages of easy handling, better product identification and enhanced transportability with an additional opportunity to market the product for better visibility and shelf impact at the store level.

With RRP’s widespread adoption initially driven by the Big Box and Club Store retailers as a way to keep prices low, this innovative secondary packaging format has not only been warmly embraced by larger supermarket chains, but also in other retail channels—primarily because it does not require y the fact that the store staff to unpack the inner contents of the RRP package.

As a recent report from market researchers The Freedonia Group points out, “Gains will be supported by further growth of mass retailers and club stores, as well as food and beverage sales volume in nontraditional outlets such as drug and dollar stores.

“Additionally, the proliferation of club stores and ‘no-frills’ deep-discount grocery stores will be especially important for RRP, as such stores primarily sell merchandise directly from secondary packaging and require their vendors to ship products in RRP.”

Projecting the U.S. market demand for RRP packaging to grow by 5.2 per cent annually over the next three years, The Freedonia Group study forecasts the U.S. market for RRP to surpass US$6.2 billion by 2020.

According to the report’s author Esther Palevsky, “Growth will be supported by expansion in the retail user base and increased presence of value-added box types.”

As Palevsky explains: “The disruptive trends in the North American food retailing landscape will bode well for RRP.

“Among such trends is the increasing competition that traditional supermarkets face from a host of alternatives, including club stores, deep discounters, mass retailers, drug stores, farmers’ markets, and e-commerce vendors.

“Increased openings of smaller-format locations by mass retailers will also promote gains for RRP,” Palevsky adds, “as these stores carry a more limited product selection than their traditional counterparts and have fewer employees.

“These stores can benefit from RRP’s ability to speed up the stocking of shelves and increase shelf space efficiency.”

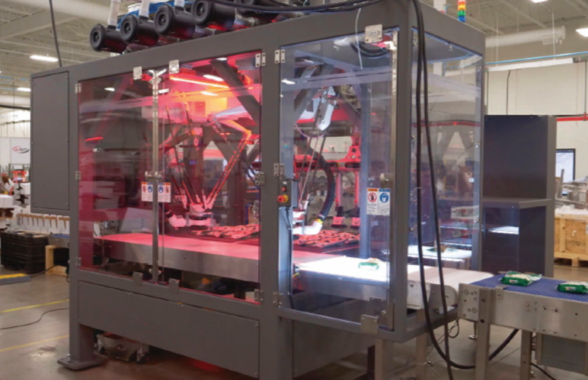

Equipped with high-speed pick-and-place robots inside the enclosure, Delkor’s MSP-m Series case-packer makes light work of placing stand-up pouches inside pre-printed retail-ready trays that can be placed directly onto the store-shelves upon their arrival with minimal effort.

According to Paula Feldman, director of business development at leading packaging industry group PMMI, The Association for Packaging and Processing Technologies in Reston, Va., “Urbanization, population and economic growth are significant drivers for RRP, especially when they are accompanied by an increase in the number of supermarkets and large box stores.

“Because RRP enhances shelf appeal and supply chain efficiency, retailers often see it as a ‘must-have,’ and use their considerable leverage with CPG manufacturers to make it happen.

“As they adjust their packaging requirements, manufacturers must continue to innovate to stay competitive,” she sates.

Tony Corsillo, general manager for the Retail Packaging & Displays Division of Toronto-headquartered corrugated packaging manufacturer Atlantic Packaging Products Limited, agrees: “Some of our customers request RRP due to retailer pressure.

“It all starts with cost-savings for the retailer to stock the shelves, which leads to lower merchandising fees.

“However, many others following are simply following suit while trying to stretch out their use of plain traditional packaging to save costs—not realizing that branding has a larger bottom-line impact in the long run,” Corsillo relates.

Pouches of the popular Fisher brand of different varieties of processed nuts are easily displayed in their upright positions on a Walmart store-shelf by the virtue of being pre-packed into the Cabrio Cases trays on Delkor’s Trayfecta G Series case formers.

THE RIGHT IMAGE

“In the end it is the impact of the brand image improvement which raises the overall sales volume,” Corsillo explains, “and many larger CPGs with a global presence and ties to Walmart, or other large retail chains in Europe, have all experienced the many benefits of switching to RRP designs.”

Going forward, Corsillo predicts the RRP format to keep growing, “Because stockability and visual appeal will become even more important as consumers begin to lower the shopping decision time.”

While Europe currently remains the largest single market for RRP packaging, “North America is anticipated to grow at a significant rate due to retail market growth in Canada and the U.S.,” according to another market study conducted by the U.S.-based Global Market Insights, Inc.

“More product visibility and brand retention are anticipated to be the key driving factors to influence marketers to adopt this technique,” the report states, “while easy transportation, reusability, and recyclability are likely to attract more retailers.”

Projecting the global market for RRP to exceed US$71 billion by 2023, the report identifies food, beverage, bakery, electronics, flowers, and health-and-beauty products as the most promising categories for future RRP market gains worldwide.

“The increase in competition among FMCG (fast-moving consumer goods) companies, owing to large number of competitors coupled with consumer shift, is likely to boost retail ready packaging market growth.”

A wide assortment of the two-piece retail-ready display trays made and filled inline by the high-speed SOMIC machinery.

Rick Gessler, vice-president of engineering at secondary packaging equipment manufacturer Delkor Systems, Inc., sees a “bright future for RRP,” citing nearly a billion Delkor-patented RRP packaging produced on Delkor equipment specifically designed specifically for this purpose annually.

Says Gessler: Yes, there are many customers buying online and that trend will likely continue to grow.

“However, the brick-and-mortar stores still play a vital role and consumers are still relying on them, particularly for daily shopping such as household groceries,” he points out.

“That puts that onus on these retailers to be more operationally efficient,” he says.

“With RRP, stores can more quickly and efficiently restock shelves with cases that are easy-to-open and visually appealing when placed on the shelf,” Gessler continues. “This helps retailers ensure that their shelves are fully stocked and that products are not missing in the aisle, while consumers can quickly find the products they are seeking in the aisle.

“It’s a win-win for both retailers and consumers,” Gessler states.

“It was important to us and to our customers to be able to offer systems that can produce multiple package formats without the need to add additional machines to those systems,” he explains, “so we took on an initiative to create new package options that were efficient in terms of packaging material usage, while also leveraging equipment that can produce multiple formats.

“As we all know, more efficient material translates to lower package cost for our customers,” Gessler elaborates, “and multi-format packaging systems translate to streamlined plant operations and flexibility to better meet the requirements of the retailers.”

With decades of experience in the manufacture of case-packers and many types of cartoning machinery, Delkor has used its expertise to develop the Trayfecta G Series former that can form both standard shipper boxes as well as the Cabrio Case RRP packages without having to add a bliss-style former to the packaging system.

“For Delkor’s customers, it’s like having three machines in one,” he says, noting that Delkor’s recently-launched Club Store Stackable Tray is produced on the Trayfecta G Series case formers.

“The versatility of the Cabrio Case is well-proven by its rapid growth,” he adds, “as its usage has grown to more than 200 million cases per year over the past three years.”

A sampling of the many types of pre-perforated RRP cases produced by WestRock to pack a wide range of consumer products in easy-to-open packaging requiring minimal manual effort to stock on the shelf without any product handling of the contents.

KEEP IT SIMPLE

Peter Fox, senior vice-president of sales for North America at SOMIC America Inc. in Bensenville, Ill., says North American retailers have some catching up to do to their European counterparts in terms of RRP adoption, especially in making more use of the display tray packaging format that has largely displaced wraparound RRP boxes in Europe.

“The most effective retail ready package is one that is simple for the stockperson to open and display, requiring no directions and absolutely no tearing of the corrugated,” says Fox. “This is why tray and cover is the dominant retail ready package,” says Fox.

“In Europe, SOMIC produces about 80 per cent of our machines for tray cover solutions,” Fox relates, “while the other 20 per cent are either wraparound case-packers or combination machines.

“While the opposite is true in the North American market, this trend will flip over the next 10 years with significant gains for tray cover applications,” says Fox, pointing to the ongoing growth of flexible packaging formats as a key driver for this trend.

“Due to the proliferation of the flexible packaging materials, the stand-up pouch and pillow-pack retail-ready presentations account for the bulk of the products we run on SOMIC lines, which have the ability to stand pouches upright for display or lie them flat for wraparound case formats—all on the same machine,” Fox explains.

“Retail markets are looking to reduce the time to get product on shelf, but at the same time do not want to look like a warehouse store,” says Fox, citing SONIC’s diverse customer base comprising leading multinational manufactures of pet food, dry foods, dairy and confectionery products, with an installation base stretching from Canada to Russia.

“Having grown up in Germany in the midst of the of the birth of the European retail-ready style packaging, SOMIC’s expertise in this field is founded in the design of our machines as well as the material designs that provide the unique retail ready packaging,” Fox states, “which is why SOMIC is a global leader in this market.

For Nicole Lipson, segment marketing manager at Norcross, Ga.-headquartered corrugated packaging giant WestRock, an effective RRP package should address the so-called “Five Easies” of being:

- easy to identify;

- easy to open;

- easy to stock;

- easy to shop;

- easy to dispose of.

“Following the tenet of the Five Easies means retailers get product on the shelves faster and consumers find shopping easier,” says Lipson, citing WestRock’s Meta brand of RRP boxes and equipment dedicated to high-speed forming of display-ready cases and trays.

“Our expertise in understanding customers’ supply chains, transportation challenges, fiber and sustainability requirements and branding guidelines means we can help them find the best solution for that product and that channel,” Lipson relates, citing a successful RRP project WestRock has recently completed for a Canadian customer.

“The customer needed a retail-ready palletized solution for a bagged product, for which it was literally hand-folding cartons manually,” she relates.

“By assessing the product, the labor and the distribution process, we recommended a WestRock trayformer and a proprietary tray design.

“With the implementation of the equipment and the new container, we helped the company realize labor and fiber savings beyond its expectation.”

Says Lipson: “All our packaging solutions are customized for each company’s specific requirements, which combined with our knowledge of equipment makes us unique in the industry—offering customers the best of both worlds.

Manufactured by SOMIC, the 424 series machines enable high-speed production of an extremely broad range of RRP tray designs to suit virtually any primary flexible package format.

CREATIVE TYPE

“We can create designs and custom RRP containers for boxes, pouches, odd-shaped cans, jars or bottles, beverages, wine and other products with a large array of designs that are proven in the grocery and club channels.”

According to Lipson, the RRP offers CPG manufacturers and their suppliers of packaging and equipment tremendous opportunities in the North American market moving forward, driven by intense competition among retailers and rapid proliferation of retail channels.

“Retailers are seeing challenges from all side: stores are moving to smaller formats; the center store is shrinking; and consumers have more places than ever to purchase their food products.

“To respond, CPG manufacturers are evolving rapidly to supply retailers with products faster than ever, hence shelf- and retail-ready packaging makes perfect sense,” Lipson states.

“Smaller store formats for specialty and grocery, for example, are the perfect environment for shelf-ready packaging due to its advantages in stocking,” she says, “while other channels such as convenience stores and dollar stores also offer good growth opportunity.

“Our goal is to help consumer products companies develop every container, for every product, for every channel,” Lipson asserts.

“With the grocery segment changing so rapidly, today’s retailers must be able to populate and stock stores quickly and easily,” Lipson concludes. “No one likes an empty shelf.”