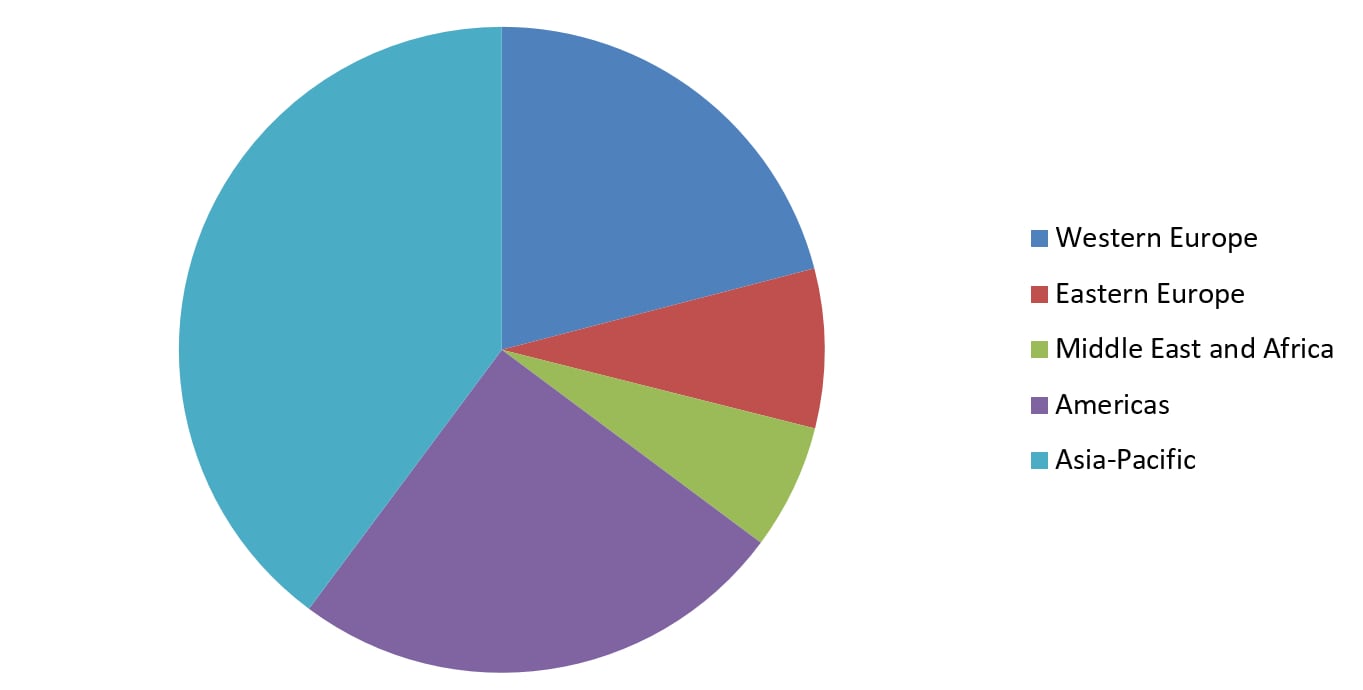

Figure: Smithers Pira

U.S. perspective

Unsurprisingly the U.S. dominates specialty paper demand in the Western hemisphere. In 2017 U.S. market share for the Americas is 64 per cent (by volume); or just over 16 per cent of global demand. Expansion in the U.S. will continue across the next five years, but at a slower rate to less mature markets in the region, principally Brazil. Across the next five years the U.S. will also be displaced by China as the world’s single largest national market for specialty papers.

The plummet in printing and writing paper demand linked to the emergence of the Internet began in the U.S., and it continues to reshape the papermaking landscape. Speciality papers have become attractive for stranded assets that are new and can be economically refocused – filtration and battery insulator papers in particular are showing good resilience in the face of the broader industry competition with polymer alternatives.

Simultaneously the paper industry continues its consolidation trend, which is carrying over into the speciality business.

Disruptive technologies

As a diverse, high-value sector, the specialty papers market provides a strong forum for the initial deployment of technical innovations, to open new market applications and realize production efficiencies.

Smithers research has identified four key developments that will help underpin future growth in specialty papers both in the North America and further afield across 2017-2022:

• Foam forming

• Precision control on large format machines

• Industry 4.0

• Stretchability

Foam forming

First developed in the 1970s, foam forming is a papermaking process that can produce nonwoven-type materials on paper machines with excellent formation uniformity, bulk and porosity. Critically successful commercialization will allow paper machines to produce nonwovens substitutes at lower costs than the current slow airlaid or wetlaid nonwoven production platforms.

Foam forming is a multi-phase fluid system structured by the presence of gas bubbles separated by thin liquid films. The bubbles impart increased sheet bulk and porosity to the paper.

As the process has undergone a series of recent technical refinements, new systems employing foam forming are now entering commercial production for specialty paper types. A key focus is maintaining sheet strength while not compromising the enhanced paper bulk; one process is employing cellulose nanofibrils (CNF) to give a reported 16 to 19 per cent improvement in tensile strength.

The first product to come from the 21st-Century foam forming development is Paptic’s extensible paper bag stock which offers a more environmentally friendly substitute for plastic.

Precision in papermaking

State-of-the-art precision technology developed for the commodity grades will steadily find a wider use on speciality machines too. These platforms offer multiple benefits with reduced product variation, resulting in tighter specifications with less waste from changeovers, rejected lots, or over-designed products that use excess fibre to cover poor variability and reproducibility.

In practice this means lighter paper grades from high-precision machines can compete with the same performance as heavier-weight papers from less precise machines. Simultaneously, superior coater designs are facilitating quick changes of coating formulations between grades with little time or material waste.

Improved product quality and costs will allow increased penetration of speciality paper grades into new applications and markets. However, a more disruptive impact will be the implementation of precision technology on faster and wider papermaking machines allowing them to compete in the speciality spaces that have hitherto relied on slower, labour-intensive papermaking.

Industry 4.0

Running in parallel to greater precision, paper making is also adapting its systems to enable greater automation and data exchange. Across all manufacturing sectors this has been dubbed Industry 4.0.

While computers have been used on paper machines since the 1960s, new systems are integrating technical processes, quality systems and supply chain management in automated harmonized systems that reduce cost and will allow larger production lines to behave like small and nimble producers of the past. In combination with new on-line sensors for real-time monitoring of product attributes these will enable owners of larger and wider machines to deliver the precision required in many specialty grades.

A fine example of this trend is the evolution of headboxes with online CD basis-weight profiling. The headbox slice is kept as straight as possible, but the excess weight in a small area is corrected by injecting water in narrow segments to displace just the excess fibre. This is finally a robust control system for headbox fibre weight distribution. It matches the precision of the new high-resolution sheet scanner systems, correcting fibre weight differences in the cross direction of the tissue sheet.

Stretchable papers

Initially developed in Europe by Gruppo di X, and beta tested with Innventia in Sweden, the capacity to develop stretchable papers is now a commercial reality via a licensing deal with BillerudKorsnäs in Europe. The mould paper produced using Gruppo di X’s trademarked Papermorphosis process relies on mechanical treatment to achieve a base sheet with 20 per cent stretchability in the machine direction and 16 per cent in the cross direction.

Stretchable papers are a new concept intended to replace plastics with natural paper webs, aligning with brand desires for a more sustainable persona, especially for single-use packaging. They can be supplied in reels that can be printed, coated and otherwise processed on traditional converting lines previously used for polymers. The key end products include tray-format packaging and pharmaceutical blisters for stiffness and advertising, paper cups and other liquid containers, and decorative foils for furniture.